Leading Advantages of Partnering With Succentrix Business Advisors for Success

Leading Advantages of Partnering With Succentrix Business Advisors for Success

Blog Article

The Advantages of Employing an Expert Service Audit Advisor

Involving a professional company bookkeeping expert can be a transformative decision for any kind of company. What certain methods can these advisors apply to customize economic services that align with your business goals?

Know-how in Financial Monitoring

.jpg)

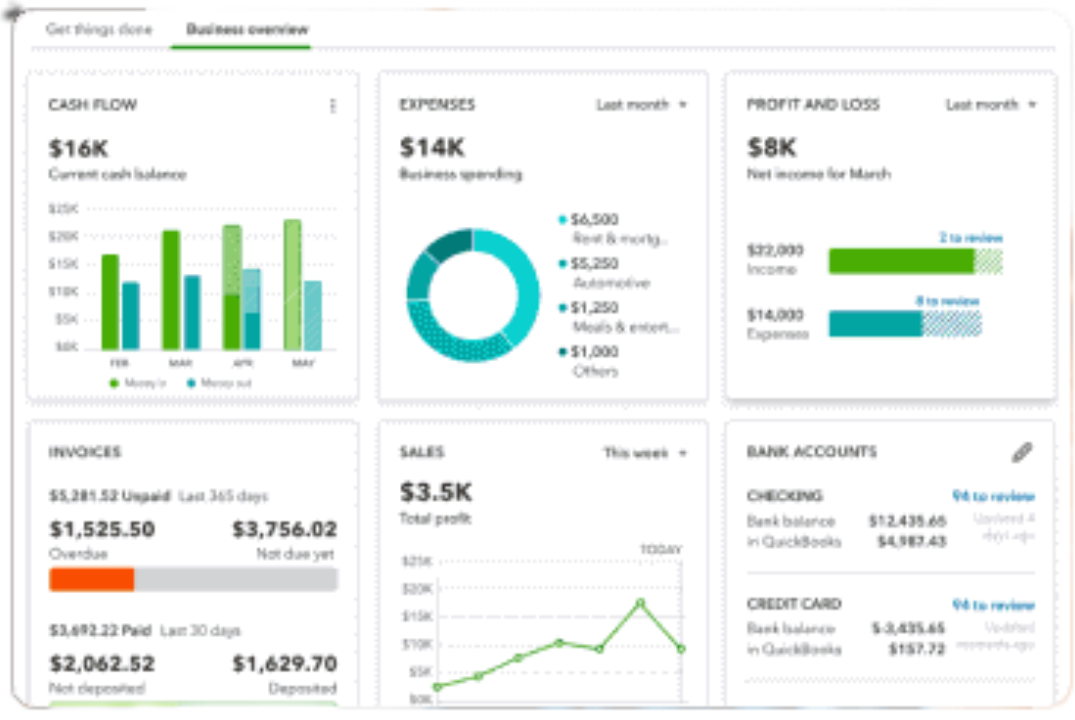

Moreover, a competent consultant can apply durable accountancy systems that give timely and exact financial info. This precision is crucial for checking efficiency and making educated choices. By leveraging their know-how, businesses can boost their monetary literacy, allowing them to analyze economic reports and recognize the effects of numerous economic methods.

Furthermore, the expert's insight into governing compliance ensures that businesses abide by economic legislations and requirements, decreasing the risk of pricey charges. They also play a critical function in tax preparation, helping to decrease responsibilities and take full advantage of cost savings. Inevitably, the calculated advice and monetary acumen provided by an expert service bookkeeping expert empower organizations to attain sustainable growth and maintain an one-upmanship in their respective industries.

Time Savings and Efficiency

Many organizations discover that partnering with a professional business audit expert results in considerable time cost savings and improved operational efficiency. By turning over monetary duties to an expert, firms can reroute their focus toward core activities that drive development and development. This delegation of jobs permits company owner and managers to focus on strategic campaigns as opposed to obtaining bogged down by daily accounting functions.

Professional experts bring streamlined processes and advanced software application remedies to the table, substantially lowering the moment spent on accounting, tax preparation, and compliance. They are adept at recognizing inadequacies and applying ideal methods that not just conserve time yet additionally minimize the threat of errors. Their know-how makes certain that target dates are fulfilled consistently, protecting against last-minute scrambles that can hinder efficiency.

With a specialist accounting advisor managing economic issues, companies can prevent the anxiety of maintaining precise records and navigating complicated laws. This efficiency cultivates an extra proactive and well organized technique to financial monitoring, eventually adding to far better source appropriation and improved overall efficiency. Succentrix Business Advisors. This way, employing a bookkeeping advisor not just saves time however likewise enhances the efficiency of company operations

Strategic Preparation and Insights

A specialist business accounting advisor plays a critical role in tactical preparation by offering important insights obtained from extensive financial analysis. Their proficiency enables organizations to comprehend their financial landscape, identify development opportunities, and make notified decisions that straighten with their lasting goals.

Furthermore, accounting experts can assist in scenario planning, assessing possible results of different strategic campaigns. This foresight equips service leaders with the expertise to browse unpredictabilities and utilize on desirable conditions. By incorporating financial data into the calculated preparation process, advisors empower organizations to craft robust business models that enhance competitiveness.

Ultimately, the collaboration with a professional audit advisor not just elevates the tactical preparation process but also fosters a society of data-driven decision-making, positioning organizations for sustained success in an increasingly dynamic market.

Conformity and Threat Mitigation

Compliance with economic guidelines and effective risk reduction are crucial for businesses aiming to preserve operational integrity and secure their possessions. Employing a specialist company bookkeeping consultant can significantly boost a firm's ability to navigate the complex landscape of financial compliance. These advisors are well-versed in the latest go to these guys regulative needs, making certain that the business follows neighborhood, state, and government regulations, therefore lessening the threat of expensive charges or legal obstacles.

Moreover, an expert consultant can identify prospective risks connected with economic techniques and advise methods to alleviate them. This aggressive method not only secures the company from unanticipated responsibilities yet additionally promotes a society of liability and transparency. By on a regular basis conducting audits and assessments, they can reveal susceptabilities in monetary processes and execute controls to address them effectively.

In addition to compliance and risk management, these advisors can give valuable insights right into best methods that straighten with industry standards. As policies continue to evolve, having a dedicated accountancy professional guarantees that companies stay responsive and nimble, permitting them to concentrate on growth and technology while guarding their economic wellness.

Personalized Financial Solutions

How can services enhance their economic approaches to satisfy distinct operational requirements? The answer hinges on employing a specialist business audit advisor who concentrates on customized monetary remedies. These professionals analyze the details challenges and objectives of a business, enabling them to create customized methods that align with the organization's vision.

Customized monetary solutions encompass a wide variety of services, consisting of capital monitoring, tax obligation preparation, projecting, and budgeting. By evaluating current financial information and market conditions, experts can produce bespoke strategies that maximize profitability while minimizing dangers. This customized strategy guarantees that businesses are not just adhering to common financial methods however are instead leveraging techniques that are especially made to sustain their functional dynamics.

Additionally, personalized services allow for versatility; as company demands advance, so as well can the financial approaches. Succentrix Business Advisors. Advisors can on a regular basis review and adjust plans to mirror modifications in the market, regulatory atmosphere, or business goals. Inevitably, the guidance of a professional bookkeeping advisor makes it possible for companies to browse intricacies with confidence, ensuring sustainable development and financial wellness tailored to their unique needs

Conclusion

In final thought, the benefits of hiring an expert service bookkeeping advisor are extensive and multifaceted. Their proficiency in find here compliance and risk reduction even more safeguards companies from regulatory challenges while maximizing tax obligation obligations.

A specialist business audit expert brings a wide range of understanding in monetary analysis, budgeting, and tactical preparation, which are vital parts for sound monetary decision-making. By leveraging their competence, services can boost their monetary literacy, allowing them to interpret monetary reports and comprehend the ramifications of various financial approaches.

Eventually, the strategic assistance and financial acumen given by a professional business audit advisor encourage organizations to achieve sustainable development and keep an affordable edge in their particular sectors.

Lots of organizations discover that partnering with a specialist service audit advisor leads to considerable time cost savings and improved functional performance. Inevitably, the advice of a specialist Website audit consultant makes it possible for services to navigate complexities with confidence, ensuring lasting growth and financial wellness tailored to their distinct demands.

Report this page